Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. This page provides - Malaysia Tourism Revenues- actual values historical data.

Pdf A Cross Country Comparison Of Taxation Systems

A company will be a Malaysian tax resident if at any time during the basis year the.

. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Direct tax collection is forecast to increase by 146 to RM1319 billion constituting 557 to total revenue. This entry records total taxes and other revenues received by the national government during the time period indicated expressed as a percent of GDP.

Tourism Revenues in Malaysia averaged 4719945 MYR Million from 1998 until 2020 reaching an all time high of 8614350 MYR Million in 2019 and a record low of 858050 MYR Million in 1998. Malaysia is divided into 13 states and three federal territories with Kuala Lumpur as. In Malaysias context income tax is the most significant direct tax.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified. However as the economy developed and with the tax reform less reliance was placed on indirect tax which starting from year 1999 the major contribution to government revenue is come from direct tax 69. It provides detailed tax revenues by sector Supranational Federal or Central Government State or Lander Government Local Government and Social Security Funds and by specific tax such as capital gains profits and income property sales etc.

In 2019 the tax revenue received in Malaysia amounted to approximately 454 billion US. Malaysias revenue from tax had decreased from a ten-year high in 2014. 26 July 2021.

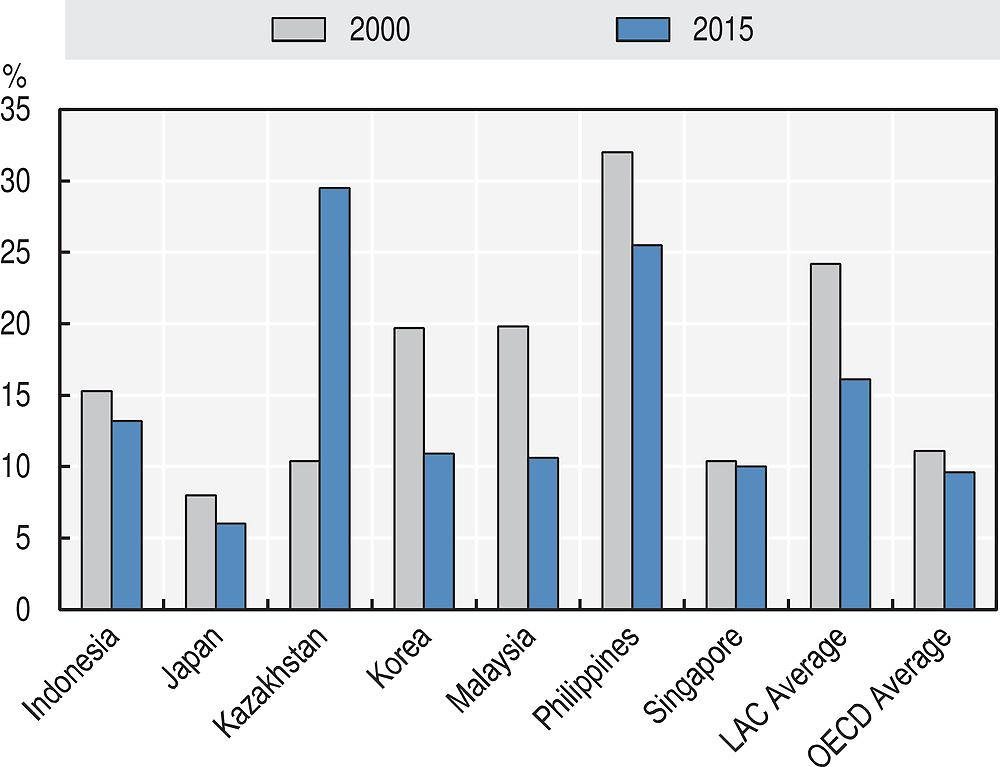

Government Revenues in Malaysia increased to 8808330 MYR Million in the fourth quarter of 2021 from 5145450 MYR Million in the third quarter of 2021. Oecdglobal-rev-stats-database Malaysias tax-to-GDP ratio was 124 in 2019 below the Asia and Pacific 24 average of 21. This dataset contains tax revenue collected by Malaysia.

Accessed May 31 2022. If the computed F-Statistic is greater than the book F-value at. Department of Statistics Malaysia Block C6 Complex C Federal Government Administrative Centre 62514 PUTRAJAYA Tel.

The value for Tax revenue current LCU in Malaysia was 174059000000 as of 2018. Malaysia Tax Revenue is at 1193 compared to 1202 last year. As a percentage to GDP tax revenue constitutes 111 while non-tax revenue at 4.

Other revenues include social contributions - such. Tax revenue refers to compulsory transfers to the central government for public purposes. Direct tax revenue in Malaysia from 2012 to 2020 in billion Malaysian ringgit Chart.

For 2019 the government is estimated to collect RM1899 billion in taxes with direct income tax at RM1238 billion 69 per cent SST at RM268 billion 15 per cent other direct tax at RM117 billion 6 per cent and other indirect tax at RM175billion 10 per cent. A non-resident individual is taxed at a flat rate of 30 on total taxable income. West Malaysia and the Malaysia Borneo region bordering Indonesia and Brunei ie.

Apr 14 2022. Taxes and other revenues. Infodosmgovmy general enquiries datadosmgovmy.

A reasonable tax rate is especially important for small and medium enterprises SMEs. 102 rows Average personal income tax and social security contribution rates on gross labour. CHIEF STATISTICIAN MALAYSIA DEPARTMENT OF STATISTICS MALAYSIA DrUzir_Mahidin Dr_Uzir.

03-8885 7000 Fax. Governmental Statistics Public Health Social. The general objective of this study is to identify the factors determine tax revenue in Malaysia from year 1990 to 2009 which is 20 years.

Whilst SMEs may not add significantly to the countrys tax revenue these enterprises provide significant employment and contribute to economic growth in various other ways. National Accounts Source Detail. The maximum rate was 30 and minimum was 25.

Taxes include personal and corporate income taxes value added taxes excise taxes and tariffs. Government Revenues in Malaysia averaged 2667430 MYR Million from 1981 until 2021 reaching an all time high of 8808330 MYR Million in the fourth quarter of 2021 and a record low of 2735 MYR Million in the first quarter of. Personal Income Tax Rate in Malaysia remained unchanged at 30 in 2021.

The result for F-Statistics. Malaysia Tax Revenue 1193 of GDP for 2019 Overview. Malaysia Personal Income Tax Rate.

03-8888 9248 Email. Accept H1 reject H0. Due to the lower tax collection the government had to rely on revenue.

In 2008 the collection of direct tax represents 52 of the Government total revenue Economic Planning Unit Ministry of Finance and Bank. What is personal tax rate in Malaysia. The higher revenue is largely attributed to better tax revenue collection which is estimated to increase by 138 to RM1744 billion.

The Peninsula Malaysia region bordering Thailand ie. In Malaysia SMEs contribute 38 to the GDP and employ 60 of the national workforce. As the graph below shows over the past 22 years this indicator reached a maximum value of 177659000000 in 2017 and a minimum value of 42388800000 in 1999.

164 of GDP 2017 est Definition. 1 Corporate Income Tax 1 2 Income Tax Treaties for the Avoidance of Double Taxation 5 3 Indirect Tax 7 4 Personal Taxation 8 5 Other Taxes 9 6 Free Trade Agreements 10. Data published Yearly by Inland Revenue Board.

Tourism Revenues in Malaysia decreased to 1268820 MYR Million in 2020 from 8614350 MYR Million in 2019. Mohd Yusrizal Ab Razak Public Relation Officer Strategic Communication and International Division Department of Statistics Malaysia Tel. English Also available in.

Malaysia located in Southeast Asia is separated by the South China Sea into two non-contiguous regions. Regional averages OECD LAC Africa 30 refer to the 2021 edition for Revenue Statistics in Latin America and the Caribbean and to the 2020 editions of the Revenue Statistics OECD and Revenue Statistics in Africa.

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Direct Tax Revenue Statista

Holding Company In Malaysia Benefits Activities Setup Tax Holding Company Company Benefits Activities

Malaysia Resources And Power Britannica

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

How Will The Government Fill The Nation S Coffers The Edge Markets

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysia Natural Resources Income Data Chart Theglobaleconomy Com

The Components Of The Government Revenue In Malaysia Download Table

Malaysia Government Spending In Dollars Data Chart Theglobaleconomy Com

Pin By Elnora Bunton On Important Statistics About Self Storage Industry Infographic By Moishes Self Storage Self Storage Mini Storage Storage Facility

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

2020 E Commerce Payments Trends Report Malaysia Country Insights

Malaysia Tax Revenue 1980 2022 Ceic Data